Regarding fundamental tax reform, there have been some interesting developments at the state level in recent years.

Utah, North Carolina, and Kentucky have all junked their so-called progressive systems and joined the flat tax club.

Utah, North Carolina, and Kentucky have all junked their so-called progressive systems and joined the flat tax club.

That’s the good news.

The bad news is that Illinois politicians are desperately trying to gut that state’s flat tax.

And the same thing is true in Massachusetts.

The Tax Foundation has a good explanation of what’s been happening in the Bay State and why it matters for the competitiveness, job creation, and entrepreneurship.

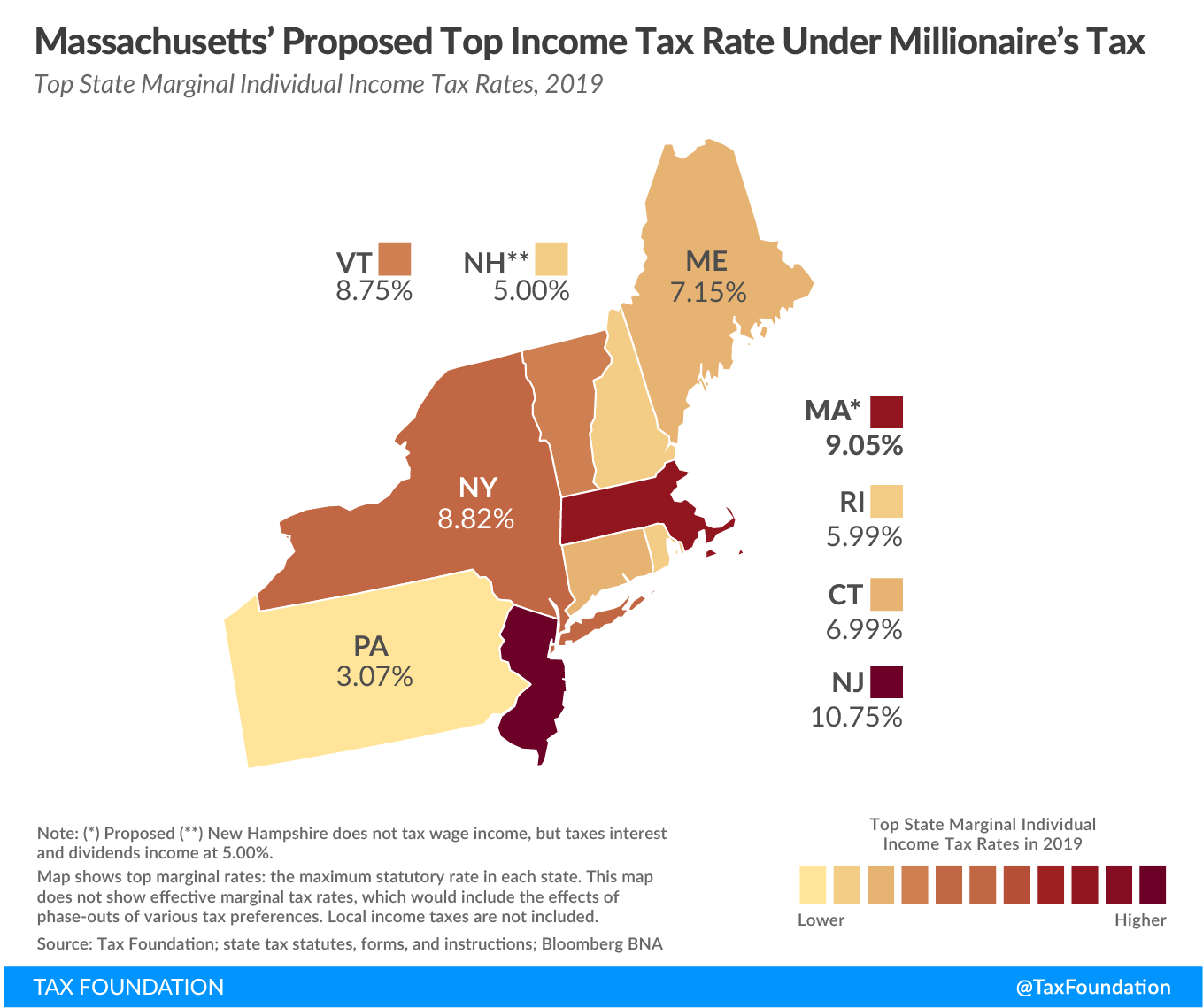

A joint constitutional convention of Massachusetts lawmakers has voted 147-48 to approve H.86, dubbed the Fair Share Amendment, to impose a 4 percent income tax surcharge on annual income beyond $1 million. The new tax would be levied in addition to the existing 5.05 percent flat rate, bringing Massachusetts’ total top rate to 9.05 percent. …Massachusetts requires legislatively-referred constitutional amendments be passed in consecutive sessions,meaning that the same measure would need to be approved in the 2021-2022 legislative session before it would be sent to voters in November of 2022. The millionaires’ tax, though targeted at a wealthy minority of tax filers in the Bay State, would cause broader harm to Massachusetts’ tax structure and economic climate. It would eliminate Massachusetts’ primary tax advantage over regional competitors… The Bay State’s low, flat income tax on individuals and pass-through businesses is the most competitive element of its tax code, giving the Commonwealth a clear strength compared to surrounding states and regional competitors. Income tax rate reductions in recent years have helped shed the moniker of “Taxachusetts” while setting up the Bay State to be a beneficiary of harmful tax rate increases in surrounding states. However, a 9.05 percent top rate would be uncompetitive even in a high-tax region. The amendment would hit Massachusetts pass-through businesses with the sixth-highest tax rate of any state.

Here’s a map showing top tax rates in the region (New Hampshire has an important asterisk since the 5-percent rate only applies to interest and dividends), including where Massachusetts would rank if the new plan ever becomes law.

The Boston Globe reports that lawmakers are very supportive of this scheme to extract more money, while the business community is understandably opposed.

A measure to revive a statewide tax on high earners received a glowing reception on Beacon Hill Thursday, suggesting an easy path ahead despite staunch opposition from business groups. “We are in desperate need for revenue for our districts,” said Senator Michael D. Brady of Brockton,one of the proposal’s more than 100 sponsors and a member of the Joint Committee on Revenue…. “We have tremendous unmet needs in our Commonwealth that are hurting families, hurting our communities, and putting our state’s economic future at risk,” said Senator Jason M. Lewis of Winchester, the lead sponsor of the Senate version of the proposal. …business groups…came armed with arguments that hiking taxes on the state’s highest earners would drive entrepreneurs — and the jobs and tax revenue they create — out of the state, as well as unfairly harm small- and mid-sized business owners whose business income passes through their individual tax returns. “Look, we’re trying to prevent Massachusetts from becoming Connecticut,” said Christopher Anderson, president of the Massachusetts High Technology Council.

Meanwhile, the Boston Herald reports that the Republican governor is opposed to this class-warfare tax.

Gov. Charlie Baker cautioned the Legislature against asking for more money from taxpayers with the so-called millionaire tax… “I’ve said that we didn’t think we should be raising taxes on people and I certainly don’t thinkwe should be pursuing a graduated income tax,” Baker told reporters yesterday. …Members of Raise Up Massachusetts, a coalition of community organizations, religious groups and labor unions, are staunchly supporting the tax that is estimated to raise approximately $2 billion a year. …The Massachusetts Republican Party is sounding the alarm on what they’re calling, “the Democrats’ newest scheme,” to “dump” the state’s flat tax system.

The governor’s viewpoint is largely irrelevant, however, since he can’t block the legislature from moving forward with their class-warfare scheme.

But that doesn’t mean the big spenders in Massachusetts have a guaranteed victory.

Yes, the next session’s legislature is almost certain to give approval, but there’s a final step needed before the flat tax is gutted.

The voters need to say yes.

And in the five previous occasions when they’ve been asked, the answer has been no.

Overwhelmingly no.

Even in 1968 and 1972, proposals for a so-called progressive tax were defeated by a two-to-one margin.

Needless to say, that doesn’t mean voters will make the right choice in 2022.

The bottom line is that if the people of Massachusetts want investors, entrepreneurs, and other job creators to remain in the state, they should again vote no.

But if they want to destroy jobs and undermine the Bay State’s competitiveness, they should vote yes.

No comments:

Post a Comment