I’ve shared three reasons why Biden’s tax plan is misguided (the tax code is biased against rich taxpayers, the tax hike would have Laffer-Curve implications, and it would saddle America with the world’s highest corporate tax burden).

For Part IV of the series, let’s explain why every piece of his plan will backfire.

There are three main arguments for higher taxes, though I don’t find any of them convincing.

- Spite and envy against successful entrepreneurs, investors, innovators, and business owners.

- Bringing more money to Washington to finance a larger burden of government spending.

- Bringing more money to Washington to ostensibly lower the burden of deficits and debt.

For what it’s worth, Biden’s proposed spending increases are far larger than his proposed tax increases, so we can rule out reason #3.

So we have to ask ourselves whether reasons #1 and #2 are compelling.

So we have to ask ourselves whether reasons #1 and #2 are compelling.

And when considering those two arguments, we also should ask whether those reasons are sufficiently compelling to justify throwing millions of Americans into unemployment and reducing the nation’s competitiveness.

The answer should be a resounding no.

In a column in the Wall Street Journal from last July, Philip DeMuth elaborated on the damage that would be inflicted by Biden’s class-warfare agenda.

Mr. Biden has proposed to reinstate the Obama tax rates for top earners while simultaneously imposing an unlimited 12.4% Social Security payroll tax on earnings over $400,000. …Mr. Biden proposes to eliminate the capital gains reset to fair market value at death. For long-term holdings, much of that gain is merely inflation, created by the government’s failure to maintain price stability, so this is effectively a tax on a tax.

The remaining gains are usually from corporate earnings, which were already taxed once, when they came in the door. It will be difficult to keep your business or farm in the family if the Biden scheme forces it to be liquidated to pay the death taxes. …If a President Biden has his way, the top capital-gains tax rate will be 39.6%—the same as for ordinary income. This could be a triple whammy: cutting the estate tax exemption in half, eliminating the capital gains reset to fair market value, and then doubling the capital-gains tax rate. A small step for the government, a giant loss for the American family. …The former vice president’s ambitious spending programs would more than offset any new revenue from his tax proposals. …This isn’t a debate between growing the pie vs. redistributing the pie; it is about everyone settling for a smaller pie.

The final two sentences deserve extra attention.

First, nobody should be deluded that tax increases will be used to reduce red ink. Yes, Biden is proposing to collect a lot more money, but he’s proposing about $2 of new spending for every $1 of projected tax revenue.

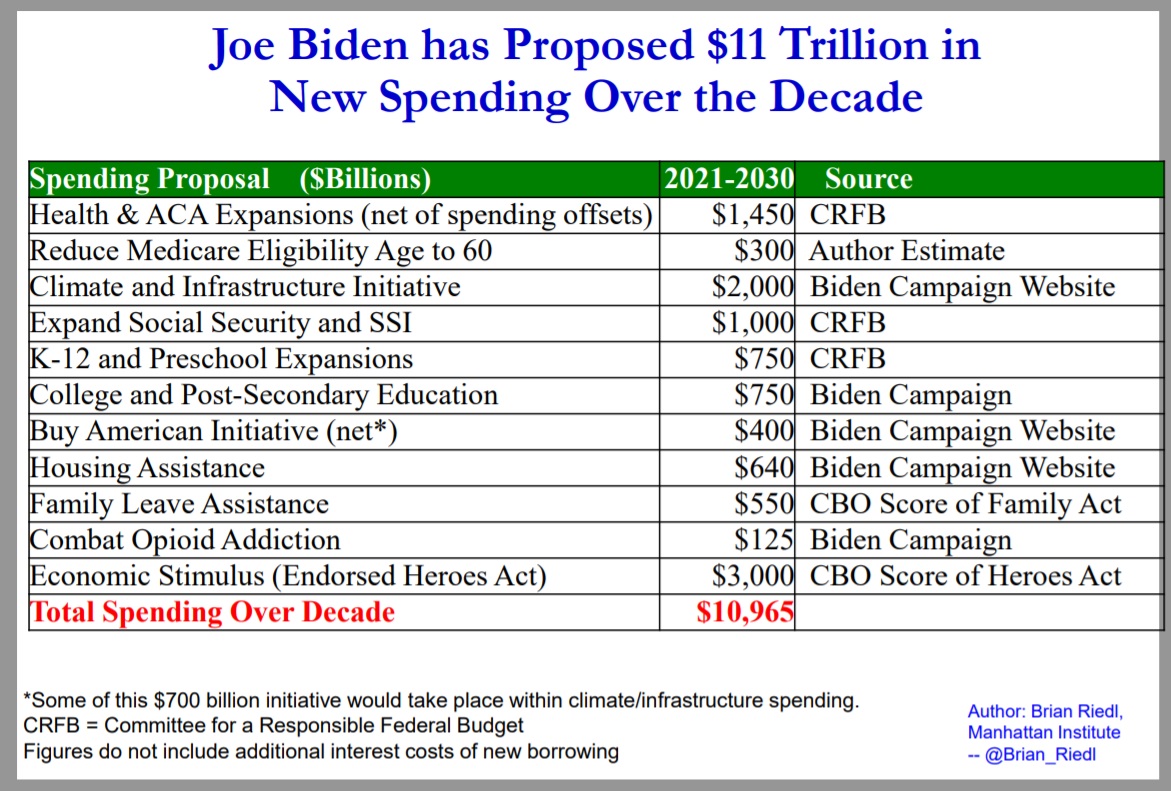

Brian Riedl’s Chartbook has the grim details on Biden’s spending agenda.

Second, the point about “growing the pie” is critically important since even a very small reduction in long-run growth will have a surprisingly large impact on household finances within a few decades.

The bottom line is that living standards in the United States are significantly higher than living standards in Europe, in large part because fiscal burdens are not as onerous in America.

Biden’s plan to make America more like France, Italy, and Greece is not a good idea.

No comments:

Post a Comment