While speaking last week at the Acton Institute in Michigan, I responded to a question about the perpetual motion machine of Keynesian economics.

For purposes of today’s column, let’s try to understand the Keynesian viewpoint.

First and foremost, they think spending drives the economy, whether consumer spending or government spending.

Critics like me argue that the focus should be on income and production. We want to increase saving, investment, entrepreneurship, and labor supply. Simply stated, money has to be earned before anyone spends it.

Keynesian economists, by contrast, think it is very important to distinguish between the long run and short run. In the long run, they generally would agree with the previous paragraph.

Keynesian economists, by contrast, think it is very important to distinguish between the long run and short run. In the long run, they generally would agree with the previous paragraph.

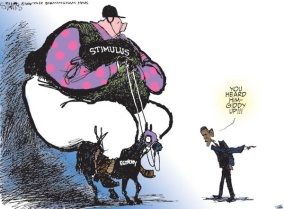

But they would argue that “stimulus” policies can be desirable in the short run if there is an economic downturn.

More specifically, they argue you can stop or minimize a recession with fiscal Keynesianism (politicians borrowing in order to boost spending) and/or monetary Keynesianism (the central bank creating money to boost spending).

I then point out that Keynesianism has a history of failure when looking at real-world evidence.

- It didn’t work for Hoover.

- It didn’t work for Roosevelt.

- It didn’t work for Japan.

- It didn’t work for Europe.

- It didn’t work for Obama.

- It didn’t work for Biden.

It’s also worth pointing out that Keynesians have been consistently wrong with predicting economic damage during periods of spending restraint.

- They were wrong about growth after World War II (and would have been wrong, if they were around at the time, about growth

when Harding slashed spending in the early 1920s).

when Harding slashed spending in the early 1920s). - They were wrong about Thatcher in the 1980s.

- They were wrong about Reagan in the 1980s.

- They were wrong about Canada in the 1990s.

- They were wrong after the sequester in 2013.

- They were wrong about unemployment benefits in 2020.

As you might expect, Keynesians would claim I’m misreading the evidence. They would argue that their policies prevented even-deeper recessions. Or that periods of spending restraint prevented the economy from growing faster.

So you can see why the debate never gets settled.

I’ll close with the observation that Keynesian policies actually can impact the economy. As I pointed out in the video, we can artificially boost overall consumption and spending in the short run if politicians finance a so-called stimulus by borrowing money from overseas. And we can lure people and businesses into borrowing and spending in the short run by having a central bank create more money.

But that’s sugar-high economics, the kind of approach that only helps vote-buying politicians.

No comments:

Post a Comment