Whether at the federal level, state level, or local level, my biggest problem with bureaucrats is that many of them work for agencies and departments that should not exist.

My second biggest problem is that they are overpaid compared to workers in the productive sector of the economy.

And I could add other concerns, such as bureaucrat misbehavior, negative macroeconomic effects, and bureaucratic sloth.

But for today’s column, let’s focus on the narrower issue of pensions for state bureaucrats. But we’re not only going to be examining the overly generous guaranteed benefits that politicians have promised.

Those numbers are important. But, courtesy of Reason‘s Pension Integrity Project, we’re also going to see whether politicians have actually set aside the amount of money needed to fund those benefits.

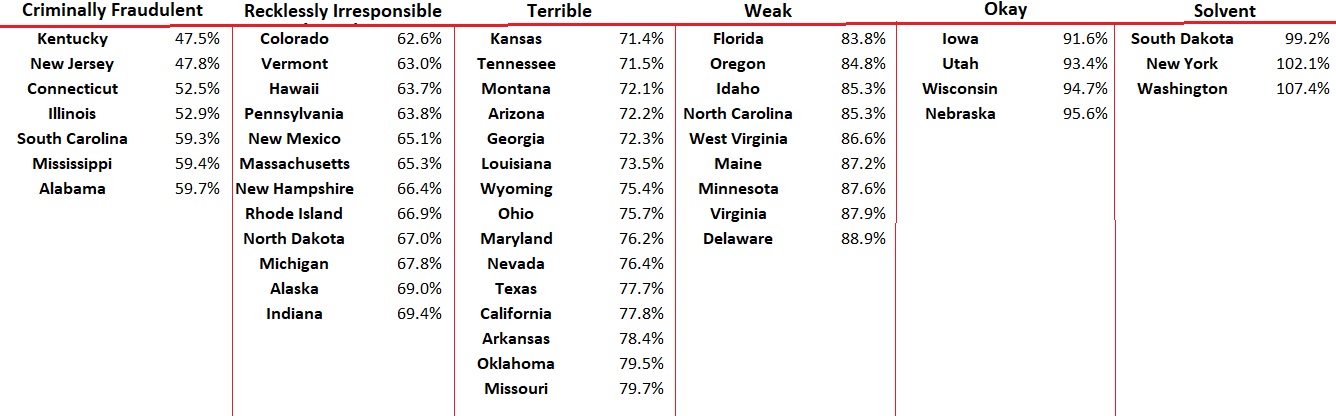

I put Reason‘s numbers into categories to see which states were saddling their residents with future problems (often referred to as unfunded liabilities).

What do we see? Lo and behold, only three states have solvent systems, with four others being in decent shape.

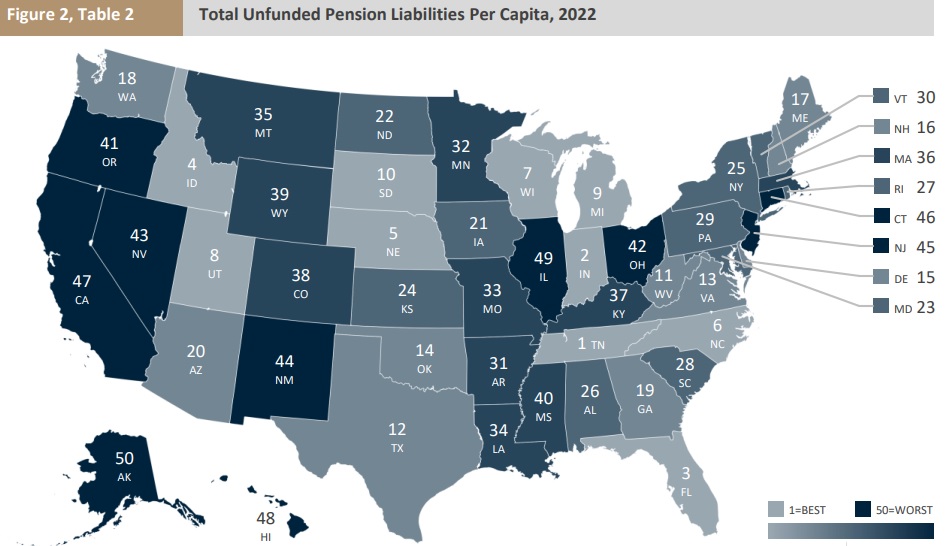

However, to properly assess the future danger to taxpayers, it’s also necessary to know the relative size of state pension plans.

For instance, if a state does not offer a lot of guaranteed benefits, then the future burden on taxpayers won’t be that large, even if the state hasn’t set aside the money to pay those benefits.

Which is why it’s also important to look at unfunded liabilities per capita. Here are those calculations, courtesy of the folks at the American Legislative Exchange Council.

Measured this way, Tennessee, Indiana, and Florida are in the best shape, even though they don’t look good in the Reason report.

Let’s conclude by seeing what states are in the top-10 and bottom-10 of both reports.

On this basis, the best states are South Dakota, Utah, Wisconsin, and Nebraska.

The worst states (to nobody’s surprise) are New Jersey, Connecticut, Illinois, Hawaii, and Mississippi.

No comments:

Post a Comment