I explained the benefits of a flat tax in a video 14 years ago. And I’ve since shared two videos (here and here) of Steve Forbes arguing for a flat tax.

If those are not enough, here’s a recent presentation I made about tax reform for Argentina’s Fundacion Internacional Bases.

I was one of three speakers and I encourage everyone to watch the entire one-hour program.

My role was to explain the three main features of the flat tax.

- A low tax rate on productive economic behavior.

- No double taxation of income that is saved and invested.

- Elimination of unfair and corrupt loopholes.

I’ve written many times on all of those topics, especially the first two.

So, for today’s column, let’s focus on the third point.

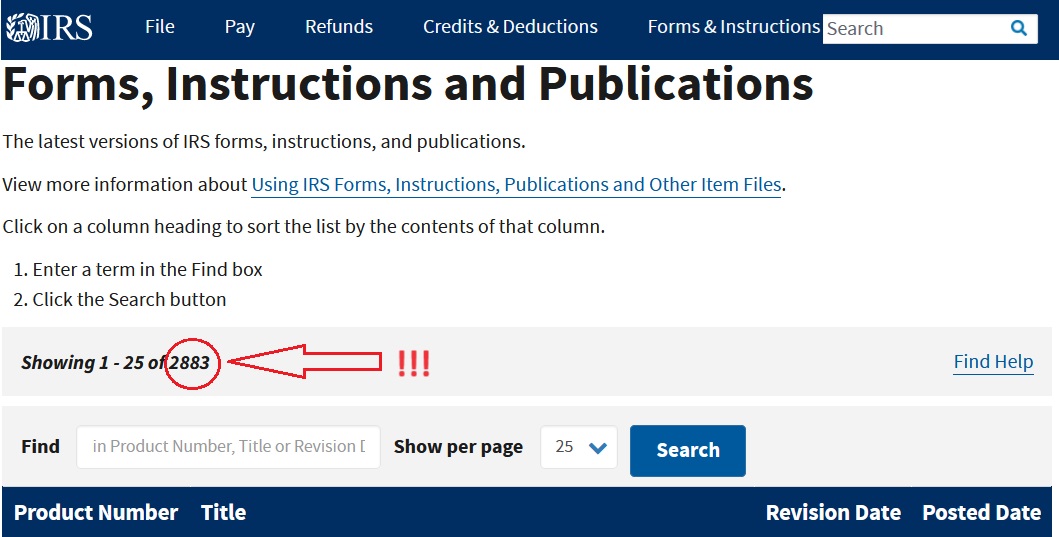

And I don’t even need to do a lot of writing because the most persuasive evidence about our complicated and unfair tax code can be found on this IRS webpage.

As of today, 2,883 forms are needed to theoretically comply with America’s nightmarish internal revenue code.

By the way, I wrote “theoretically” because many taxpayers have no idea whether they are accurately complying. The tax code is too much of a Byzantine mess.

As an economist, I want a flat tax so we can enjoy faster growth.

As a human being, I want a simple system to get rid of unfairness and complexity.

P.S. Sadly, some folks on the left don’t understand the flat tax.

No comments:

Post a Comment