For libertarians, there aren’t many good role models in the world. There are a few small jurisdictions such as Bermuda, Monaco, and the Cayman Islands that are worth highlighting because of strong rule of law and good fiscal policy. There are also a few medium-sized nations that are – by modern standards – very market-oriented, such as Switzerland, Singapore, and New Zealand.

But Hong Kong generally gets top rankings for economic liberty. Which helps to explain why I’m so worried about a potential crackdown by China.

As I noted in the interview, intervention by Chinese security would not be good news for Hong Kong.

But it also would be bad news for China’s economy. Especially since it already is dealing with the adverse consequences of both internal statism and external protectionism.

Indeed, the only reason I’m not totally pessimistic is that the power elite in China doubtlessly would experience a big loss in personal wealth if there is a crackdown.

That being said, I can’t imagine President Xi will allow China’s implicit control over Hong Kong to diminish. So I’m reluctant to make any prediction.

But I very much hope that Hong Kong will emerge unscathed, in part because I don’t want to lose a very good example of the link between economic liberty and national prosperity.

Marian Tupy, writing for CapX, explains that Hong Kong is a great role model.

In 1950, …compared to the advanced countries of the West, Hong Kong was still a relative backwater. …the average resident of the colony earned 35 per cent and 25 per cent compared to British and American citizens respectively. Today, average income in Hong Kong is 37 per cent and 3 per cent higher than that in the United Kingdom and America.…Unlike some British ex-colonies and the United Kingdom itself, Hong Kong never experimented with socialism. Historically, the government played only a minor role in the economy… The territory kept taxes flat and low… The territory followed a policy of unilateral trade liberalisation, which is to say that the colony allowed other countries to export to Hong Kong tariff-free, regardless of whether other countries reciprocated or not. …In 1755, the great Scottish economist Adam Smith…wrote, “Little else is requisite to carry a state to the highest degree of opulence from the lowest barbarism, but peace, easy taxes, and a tolerable administration of justice…” Hong Kong prospered because it followed Smith’s recommendations.

Here’s his chart showing how Hong Kong has surpassed both the United Kingdom and United States in terms of per-capita economic output.

In a column for the Wall Street Journal, Jairaj Devadiga explains a key factor in Hong Kong’s success.

Sir John Cowperthwaite was Hong Kong’s financial secretary from 1961-71 and is widely credited for the prosperity Hong Kong enjoys today. An ardent free-marketeer, Cowperthwaite believed that government should not try to manage the economy. One salient feature of Cowperthwaite’s policies:His administration didn’t collect any economic data during his tenure. Not even gross domestic product was calculated. When the American economist Milton Friedman asked why, Cowperthwaite replied that once the data were made available, officials would invariably use them to make the case for government intervention in the economy. …Without data, busybody bureaucrats had no way of justifying interference in the economy. In Cowperthwaite’s Hong Kong, the government did only the bare minimum necessary, such as maintaining law and order… The rest was left to the private sector. …When asked what poor countries should do to emulate Hong Kong’s success, he replied, “They should abolish the office of national statistics.”

Amen.

When you give data to politicians and bureaucrats, they generally find something they don’t like and then can’t resist the temptation to intervene.

Now that we’ve looked at some of the factors that enabled Hong Kong’s prosperity, let’s consider what may happen if there’s a crackdown by China.

Professor Tyler Cowen shares a pessimistic assessment in his Bloomberg column.

Hong Kong has been a kind of bellwether for the state of freedom in the wider world. …By 1980, Milton Friedman’s “Free to Choose” series was on television, portraying Hong Kong as a free economy experiencing huge gains in living standards. The skyline was impressive, and you could get all the necessary permits to start a business in Hong Kong in just a few days. The territory showed how Friedman’s theories worked in the real world. Hong Kong stood as a symbol of a new age of freer markets and growing globalization.…Hong Kong still ranks near or at the top of several indices of economic freedom. But…[n]ot only is there the specter of Chinese intervention, but there is also a broader understanding that the rules of the game can change at any time… Meanwhile, many Hong Kong residents know their behavior is being monitored and graded, and they know the role of the Chinese government will only grow. …Freedom is not merely the ability to buy and sell goods at minimum regulation and a low tax rate, variables that are readily picked up by economic freedom indices. Freedom is also about the…legitimacy and durability of their political institutions. …Circa 2019, Hong Kong is a study in the creeping power and increasing sophistication of autocracy. While it is possible there could be a Tiananmen-like massacre in the streets of Hong Kong, it is more likely that its mainland overlords will opt for more subtle ways of choking off Hong Kong’s remaining autonomy and freedoms. …right now, I would bet on the Chinese Communist Party over the protesters.

If Cowen is right, one thing that surely will happen is that money will flee.

And that may already be happening. Here are some excerpts from a Bloomberg report.

Private bankers are being flooded with inquiries from investors in Hong Kong…wealthy investors are setting up ways to move their money out of the former British colony more quickly, bankers and wealth managers said. A major Asian wealth manager said it has received a large flow of new money in Singapore from Hong Kong over recent weeks,requesting not to be identified due to the sensitivity of the issue. One Hong Kong private banker said the majority of the new queries he receives aren’t coming from the super-rich, most of whom already have alternative destinations for their money, but from individuals with assets in the $10 million to $20 million range. …The extradition fight reinforced concerns among Hong Kong investors and democracy advocates alike that the Beijing-backed government is eroding the legal wall separating the local judicial system from the mainland’s. …The recent demonstrations are the latest trigger in a long process of Chinese money flowing to Singapore, London, New York and other centers outside Beijing’s reach. …“Hong Kong has shot itself in the foot,” said Chong, a Malaysian who has permanent residency in both Hong Kong and Singapore. “Can you imagine Singapore allowing this?”

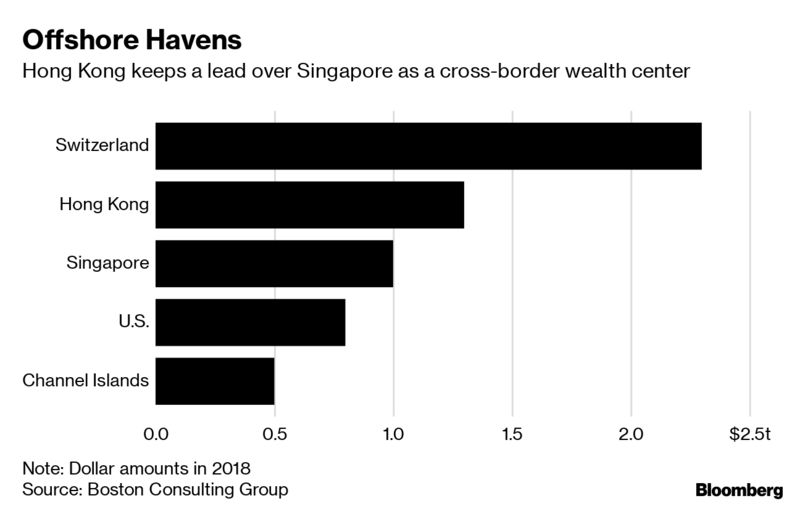

And keep in mind that big money is involved. Here’s a chart that accompanied the analysis.

Looking at these numbers, I want to emphasize again that China also will suffer if a crackdown causes money to flee Hong Kong.

Which is President Xi should resist the urge to intervene.

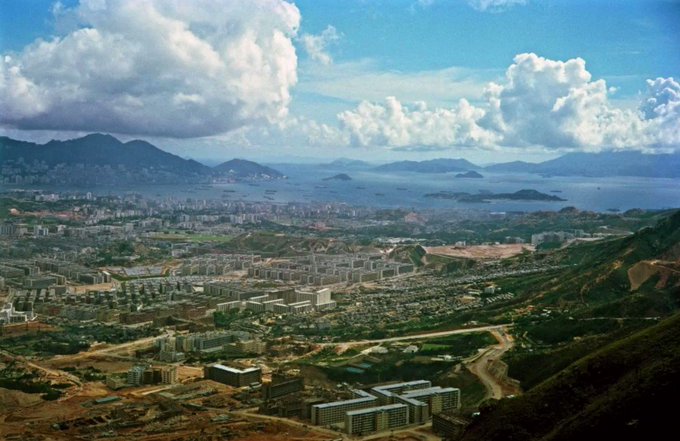

I’ll close with this visual depiction of Hong Kong’s amazing growth.

Let’s hope Beijing doesn’t try to reverse this progress.

P.S. You’ll notice that I didn’t advocate for democracy, either in this column or in the interview. That’s because I’m more concerned with protecting and promoting liberty. Yes, it’s good to have a democratic form of government. If I understand correctly, there’s also an empirical link between political freedom and economic freedom. But sometimes democracy simply means the ability to take other people’s money, using government as the middleman. That’s why the people of not-very-democratic Hong Kong are much better off than the people of democratic Greece.

on vacation!

on vacation!

No comments:

Post a Comment