The crowd in Washington has responded to the coronavirus crisis with an orgy of borrowing and spending.

The good news is that the legislation isn’t based on the failed notion of Keynesian economics (i.e., the belief that you get more prosperity when the government borrows money  from the economy’s left pocket and then puts it in the economy’s right pocket).

from the economy’s left pocket and then puts it in the economy’s right pocket).

from the economy’s left pocket and then puts it in the economy’s right pocket).

from the economy’s left pocket and then puts it in the economy’s right pocket).

Instead, it is vaguely based on the idea of government acting as an insurer for unforeseen loss of income.

Not ideal from a libertarian perspective, of course, but we can at least hope it might be somewhat successful in easing temporary hardship and averting bankruptcies of otherwise viable businesses.

The bad news is that the legislation is filled with corrupt handouts and favors for the friends and cronies of politicians. Simply stated, they have not “let a crisis go to waste.”

The worst news, however, is that politicians have plenty of additional ideas for how to exploit the crisis.

An especially awful idea for so-called stimulus comes from House Speaker Nancy Pelosi, who wants to restore (retroactively!) the full federal deduction for state and local tax payments.

Pelosi suggested that reversing the tax law’s $10,000 cap on the state and local tax (SALT) deduction… The cap on the SALT deductionhas been strongly disliked by politicians in high-tax, Democratic-leaning states such as New York, New Jersey and California… But most Republicans support the SALT deduction cap, arguing that it helps to prevent the tax code from subsidizing higher state taxes.

I’ve written many times on this issue and explained why curtailing that deduction (which basically existed to subsidize the profligacy of high-tax states) was one of the best features of the 2017 tax reform.

Needless to say, it would be a horrible mistake to reverse that much-needed change.

The Wall Street Journal agrees, opining on Pelosi’s proposal to subsidize high tax states.

Democrats are far from finished using the crisis to try to force through partisan priorities they couldn’t pass in normal times. Mrs. Pelosi is now hinting the price for further economic relief may include expanding a regressive tax deduction for high-earners in states run by Democrats.…In the 2017 tax reform, Republicans limited the state and local tax deduction to $10,000. …Democrats have been trying to repeal the SALT cap since tax reform passed. …Blowing up the state and local tax deduction would…also make it easier for poorly governed states to rely on soaking their high earners through capital-gains and income taxes, because the federal deduction would ease the burden. …Mrs. Pelosi’s remarks underscore the potential for further political mischief and long-term damage as the government intervenes… When Democrats next complain that Republicans want to cut taxes “for the rich,” remember that Mrs. Pelosi wants to cut them too—but mainly for the progressive rich in Democratic states.

Maya MacGuineas of the Committee for a Responsible Federal Budget also denounced the idea.

This is not the time to load up emergency packages with giveaways that waste billions of taxpayer dollars… Weakening or eliminating the SALT cap would be regressive, expensive, poorly targeted, and precisely the kind of political giveawaythat compromises the credibility of emergency spending. …Retroactively repealing the SALT caps for the last two years would mean sending a check of $100,000 to the household making over $1 million per year, and less than $100 for the average household making less than $100,000 per year. …During this crisis, the Committee implores special interest lobbyists to stand down and lawmakers to put self-serving politics aside.

By the way, I care about whether a change in tax policy will make the country more prosperous in the long run and don’t fixate on whether the change helps or hurts any particular income group. So Maya’s point about the rich getting almost all the benefits is not what motivates me to oppose Pelosi’s proposal.

That being said, it is remarkable that she is pushing a change that overwhelmingly benefits the very richest people in the nation.

The obvious message is that it’s okay to help the rich when a) those rich people live in places such as California, and b) helping the rich also makes it easier for states to impose bad fiscal policy.

Which is why she was pushing her bad idea before the coronavirus ever became an issue. Indeed, House Democrats even passed legislation in 2019 to restore the loophole.

Professor John McGinnis of Northwestern University Law School wrote early last year why the deduction was misguided and why the provision to restrict the deduction was the best provision of the 2017 tax law.

…the best feature of the Trump tax cuts was the $10,000 cap on the deductibility of state and local taxes. It advanced one of the Constitution’s most important structures for good government—competitive federalism. Deductibility of state taxes deadens that competition,because it allows states to slough off some of the costs of taxation to citizens in other states. Moreover, it allows states to avoid accountability for the taxes they impose. Given high federal tax rates in some brackets, high income tax payers end up paying only about sixty percent of the actual tax imposed. The federal government and thereby other tax payers effectively pick up the rest of the tab. …the ceiling makes some taxpayers pay more, but its dynamic effect is to make it less likely that state and local taxes, particularly highly visible state income taxes, will be raised and more likely that they will be cut.

For what it’s worth, I think the lower corporate tax rate was the best provision of the 2017 reform, but McGinnis makes a strong case.

Perhaps the best evidence for this change comes from the behavior of politicians from high-tax states.

Here are some excerpts from a Wall Street Journal editorial from early last year.

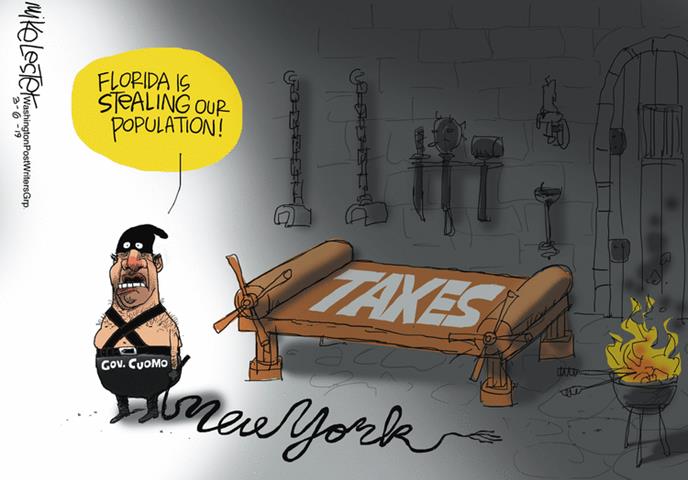

New York Gov. Andrew Cuomo…is blaming the state’s $2.3 billion budget shortfall on a political party that doesn’t run the place. He says the state is suffering from declining tax receipts because the GOP Congress as part of tax reform in 2017limited the state-and-local tax deduction to $10,000. …the once unlimited deduction allowed those in high tax climes to mitigate the pain of state taxes. It amounted to a subsidy for progressive policies. …The real problem is New York’s punitive tax rates, which Mr. Cuomo and his party could fix. “People are mobile,” Mr. Cuomo said this week. “And they will go to a better tax environment. That is not a hypothesis. That is a fact.” Maybe Mr. Cuomo should stay in Albany and do something about that reality.

Amen.

The federal tax code should not subsidize politicians from high-tax states. Nor should it subsidize rich people who live in high-tax states.

If Governor Cuomo is worried about rich people moving to Florida (and he should be), he should lower tax rates and make government more efficient.

If Governor Cuomo is worried about rich people moving to Florida (and he should be), he should lower tax rates and make government more efficient.

I’ll close with the observation that the state and local tax deduction created the fiscal version of a third-party payer problem. It reduced the perceived cost of state and local government, which made it easier for politicians to increase taxes (much as government subsidies for healthcare and higher education have made it easier for hospitals and colleges to increase prices).

P.S. Speaking of fake stimulus, there’s also plenty of discussion on Capitol Hill (especially given Trump’s weakness on the issue) about squandering a couple of trillion dollars on infrastructure, even though such spending a) should not be financed at the federal level, b) would not have any immediate impact on jobs, and c) would be a vehicle for giveaways such as mass transit boondoggles.

No comments:

Post a Comment