A regular theme of these columns is that the economy is not a fixed pie. If Person A becomes rich, that doesn’t mean less income for Persons B and C.

Indeed, the evidence is very strong that successful entrepreneurs only capture a tiny fraction of the wealth they create.

And there’s also lots of data showing how average incomes can rise over time and how all segments of society tend to rise together.

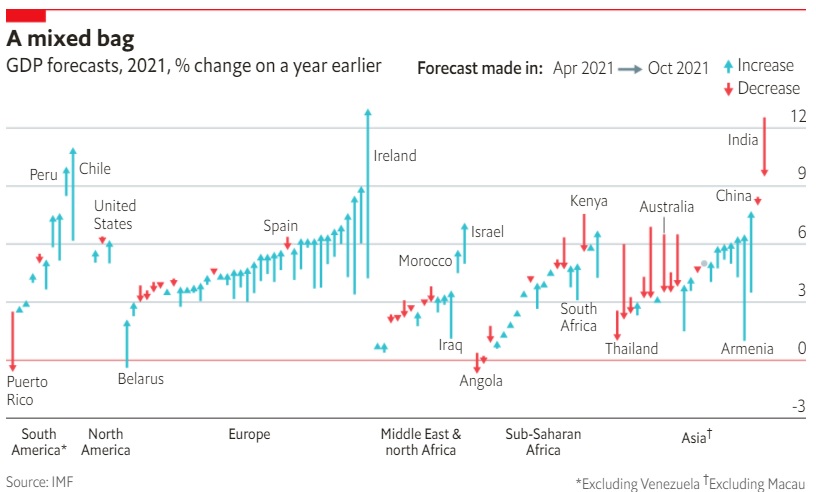

My reason for revisiting this topic is a story in the Economist about the possibility of an “grossly uneven” recovery, as illustrated by this chart.

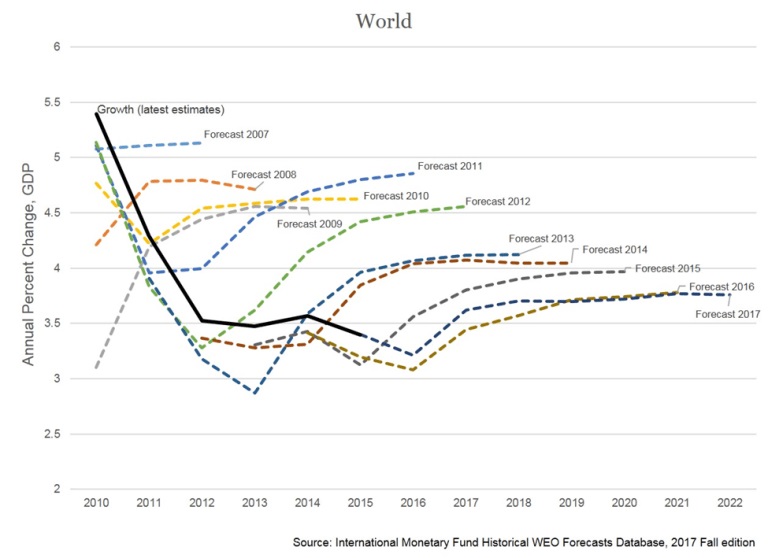

My knee-jerk reaction to this chart is that nobody should pay attention to economic forecasters for the simple reason that they have a terrible track record.

And IMF economists seems to be among the worst of the worst  when they make predictions.

when they make predictions.

This may be because economists at the IMF have a mistaken Keynesian view of the economy.

Or it may simply reflect the fact that it’s basically impossible to make such predictions (if any economists actually had that ability, they would be billionaires).

But today’s topic isn’t the foibles of the economics profession.

Instead, I want to focus on this issue of whether rich countries should be blamed for being richer than poor countries.

Here’s some of what the Economist wrote.

Over the longer term, the economic recovery is projected to remain grossly uneven. That, the fund argues, reflects…variations in fiscal largesse. In 2020 rich and poor countries alike loosened the purse-strings to protect households and businesses from the impact of lockdowns.

This year fiscal support in the rich world is projected to remain broadly as generous as it was last year, allowing time for the private sector to get back on its feet (and, some economists would argue, even leading to some overheating in America). Emerging markets, by contrast, have shrunk their budget deficits (adjusted for the economic cycle, and before interest payments). The result will be a two-speed global economy. Output in the rich world is expected to return to its pre-pandemic trend by next year, and then to rise slightly above it. For the rest of the world, however, gdp is expected to remain well below trend at least until 2025.

As you can see from the excerpt, the IMF is wedded to the Keynesian view that government spending supposedly is good for growth – notwithstanding all the real-world evidence to the contrary.

But I’m more interested in the two points that aren’t mentioned, both of which revolve around the strong link between economic liberty and national prosperity.

- First, rich countries tend to be rich because they have (or had) good economic policy.

- Second, poor countries fail to converge because they tend to have bad economic policy.

For what it’s worth, the IMF’s failure to grasp these two points may help to explain why the bureaucracy advises poor countries to make bad choices.

The bottom line is that the global economy is not a fixed pie. If there are “grossly uneven” growth rates in the world, the reason is that some nations don’t follow the prudent recipe for prosperity.

No comments:

Post a Comment