The good news is that President Biden wants the United States to be at the top. The bad news is that he wants America to be at the top in bad ways.

- The highest corporate income tax rate.

- The highest capital gains tax rate.

- The highest level of double taxation.

We can now add another category, based on the latest iteration of his budget plan.

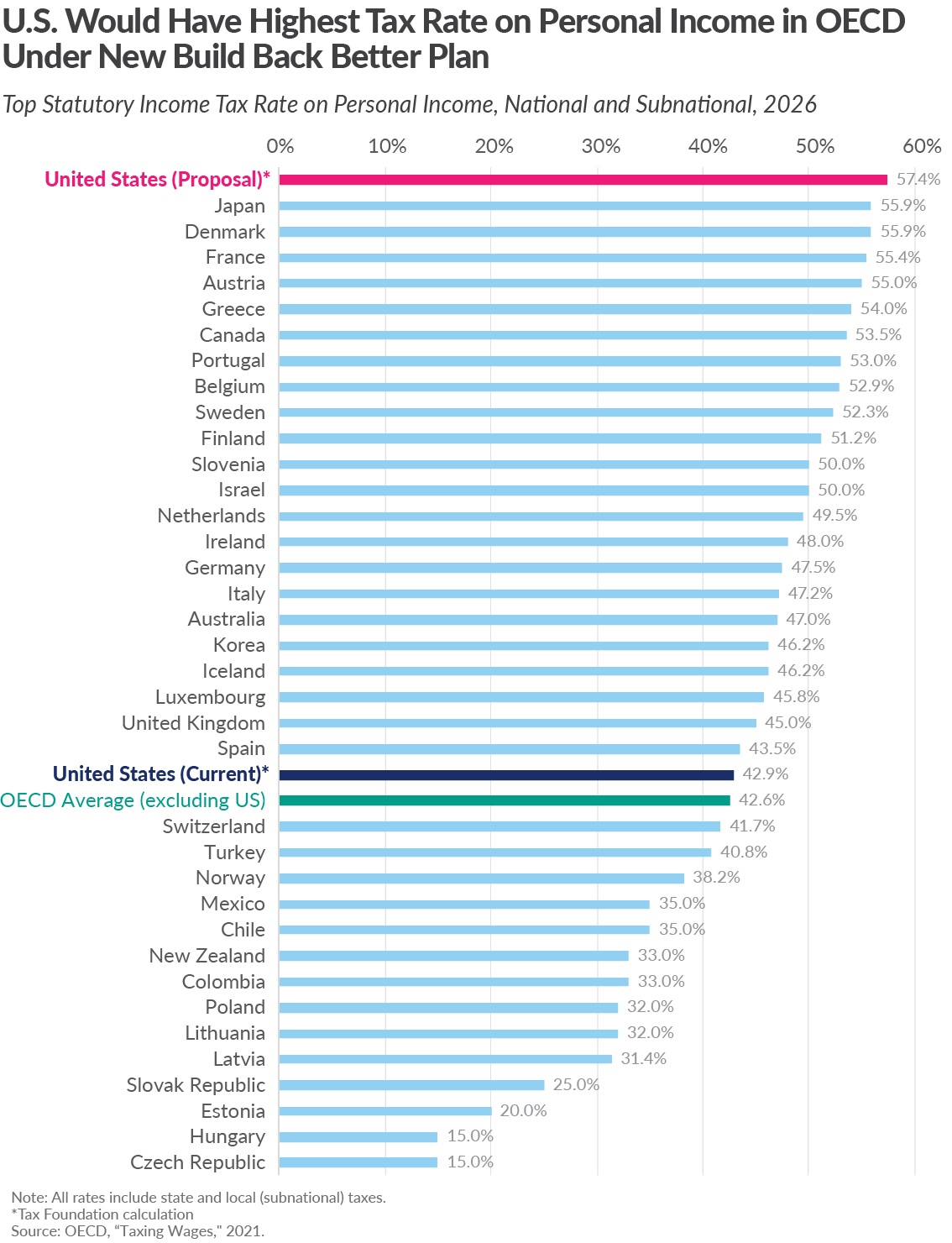

According to the Tax Foundation, the United States would have the develop world’s most punitive personal income tax.

Worse than France and worse than Greece. How embarrassing.

In their report, Alex Durante and William McBride explain how the new plan will raise tax rates in a convoluted fashion.

High-income taxpayers would face a surcharge on modified adjusted gross income (MAGI), defined as adjusted gross income less investment interest expense. The surcharge would equal 5 percent on MAGI in excess of $10 million plus 3 percent on MAGI above $25 million, for a total surcharge of 8 percent. The plan would also redefine the tax base to which the 3.8 percent net investment income tax (NIIT) applies

to include the “active” part of pass-through income—all taxable income above $400,000 (single filer) or $500,000 (joint filer) would be subject to tax of 3.8 percent due to the combination of NIIT and Medicare taxes. Under current law, the top marginal tax rate on ordinary income is scheduled to increase from 37 percent to 39.6 percent starting in 2026. Overall, the top marginal tax rate on personal income at the federal level would rise to 51.4 percent. In addition to the top federal rate, individuals face taxes on personal income in most U.S. states. Considering the average top marginal state-local tax rate of 6.0 percent, the combined top tax rate on personal income would be 57.4 percent—higher than currently levied in any developed country.

Needless to say, this will make the tax code more complex.

Lawyers and accountants will win and the economy will lose.

I’m not sure why Biden and his big-spender allies have picked a complicated way to increase tax rates, but that doesn’t change that fact that people will have less incentive to engage in productive behavior.

that people will have less incentive to engage in productive behavior.

What matters is the marginal tax rate on people who are thinking about earning more income.

And they’ll definitely choose to earn less if tax rates increase, particularly since well-to-do taxpayers have considerable control over the timing, level, and composition of their income.

P.S. Based on what happened in the 1980s, we can safely assume that Biden’s class-warfare plan won’t raise much money.

No comments:

Post a Comment