There are some very important long-run demographic and cultural trends in the United States.

The aging of the population – and the concomitant problem of poorly designed entitlement programs – probably belongs at the top of the list.

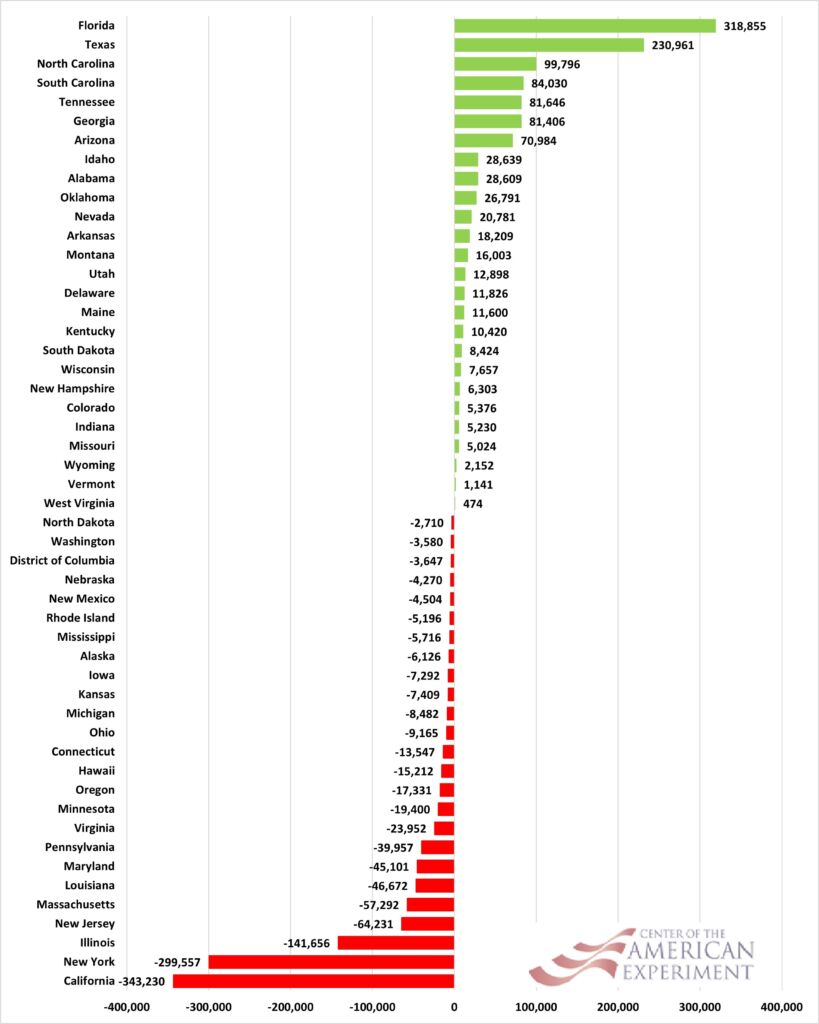

But another big trend is internal migration, which occurs when Americans move from one state to another.

But another big trend is internal migration, which occurs when Americans move from one state to another.

There are many reasons why people (and businesses) relocate, but tax policy seems to be an important factor.

Simply stated, some state governments grab a lot of money and don’t provide much value in return.

So it makes sense that some people will move to states with lower tax burdens and better-quality governments.

That’s bad news for high-tax states.

But some of them have responded wisely by lowering tax rates (North Carolina, for instance, used to have one of America’s 10-worst tax systems and now is ranked in the top 10).

Others, however, want to double-down on bad policy. In a report earlier this month for the Washington Post, Julie Zauzmer Weil shares some details about a multi-state proposal for wealth taxes.

Left-leaning proponents of taxing the assets held by America’s billionaires have a new target: In lieu of a federal wealth tax, state lawmakers want to tax billionaires where they live, in states like California, Washington and New York.

A group of legislators in statehouses across the country has coordinated to introduce bills simultaneously in seven states… The state legislators say they would like to try such ideas as a test case for future national policy while acting collectively to minimize the threat of people moving to a nearby lower-tax state. …said Noel Frame (D), a state senator in Washington. “…This is why we are all here together. No longer will states “get pitted against each other,”… Del. Jheanelle K. Wilkins (D-Montgomery),…said…“That’s quite a bit of funds that we’re leaving on the table.”

If you read the details, these state lawmakers are not proposing the same policy. They’re not even necessarily focusing on wealth taxes.

Yes, some of them have introduced state wealth taxes, but others are proposing higher capital gains taxes, some are proposing higher death taxes, and others want to impose mark-to-market taxes which are a strange combination of wealth taxation and capital gains taxation.

In every case, though, they are digging their own graves. The Wall Street Journal opined on the proposed multi-state cartel of greed.

Democrats finally have a strategy to stop billionaires from fleeing high tax states: Block the escape routes. That’s the logic behind coordinated moves in progressive states to tax wealth. …The legislators say their plans will fund social spending, but they have a specific recipient in mind.

The multistate launch was coordinated by Fund Our Future, an advocacy group affiliated with the American Federation of Teachers. As usual, public unions are pushing the progressive lawmakers they fund to tap new streams of tax revenue so they can get bigger salaries and pensions. …Each of the new tax schemes would speed up the flight from the states trying to impose them, and our readers might think even Albany and Sacramento can’t be that dumb. But ideas that begin in the progressive fringes tend to become Democratic orthodoxy these days. For those planning ahead, real-estate agents in Texas and Florida are standing by.

Building on what the WSJ wrote, the class-warfare crowd is only partly blocking the escape routes.

If these proposals become law, it may not make sense to move from California to New York, or from Illinois to Connecticut.

But there are more than 40 states that are not part of this hate-and-envy cartel. Including a bunch of states with no income taxes and others with flat taxes.

And the editorial correctly observes that real-estate agents in Texas and Florida are probably salivating at the prospect of more tax refugees looking for nice homes.

The bottom line is that there are clever ways to push for tax cartels (for example, the OECD’s despicable campaign to squash tax competition). By contrast, the states mentioned in this column are pushing a really dumb, sure-to-fail approach.

No comments:

Post a Comment