My book on fiscal policy, co-authored with Les Rubin, is now officially published.

I wrote a sneak-peak column about The Greatest Ponzi Scheme on Earth last week.

I wrote a sneak-peak column about The Greatest Ponzi Scheme on Earth last week.

There are three main takeaways from our book.

- The problem is spending

- The problem is spending

- The problem is spending

Okay, I’ll admit those bullet points are an oversimplification.

But there’s a reason for that.

Our book does show how we got into our current fiscal mess (because of too much spending).

And it shows why things will get worse in the future if we leave government on autopilot (because of too much spending).

Moreover, we have lots of evidence for the right way to avert a fiscal disaster. Richard Rahn wrote about our book in his Washington Times column.

In a new book, “The Greatest Ponzi Scheme: How the U.S. Can Avoid Economic Collapse,” Leslie A. Rubin and Daniel J. Mitchell provide a well-written and informative history of how much of the world and particularly the United States managed to get into the current fiscal mess. …British Prime Minister Margaret Thatcher said it best: “The problem with socialism is that you eventually run out of other people’s money.”

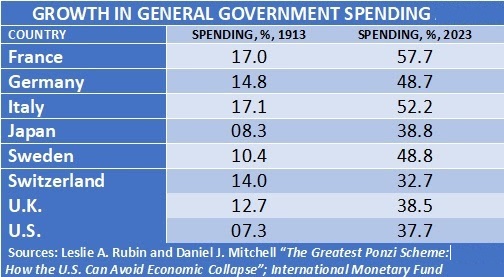

Before World War I, government spending in almost every country was a small share of gross domestic product. …In the United States, things began to change in the 1930s with the development of welfare programs… Mr. Rubin and Mr. Mitchell review many of the so-called entitlement programs that are the real budget busters. The payments from these programs consistently grow faster than the economy or tax revenue and now consume the bulk of the federal budget. Anyone who can do basic math can quickly understand the problem. When a country reaches the point where it is borrowing just to pay interest on the debt, game over.

That’s the bad news in the book. And Richard captures some of that bad news with this table showing how the burden of government spending has significantly increased over the past 100-plus years.

But our book also has good news, as Richard explains.

Fortunately, there are a number of success stories that serve as role models of what to do. …Switzerland is perhaps the best model for fiscal responsibility in a highly developed country, in that for the most part the Swiss keep government spending growing no more rapidly than the private sector.

As you might expect, I like his conclusion.

Mr. Rubin and Mr. Mitchell have done a great service in providing a highly understandable book, outlining the disaster about to engulf us if we do not change quickly, but equally important, a road map for getting out. Every policymaker and concerned citizen ought to buy this book and refer to it often — an economic bible of sin and salvation.

I want you to buy the book, but if you are a regular reader of this column, you already know the only practical way of averting a fiscal crisis in the United States. Simply follow the Golden Rule. And, because of its spending cap, Switzerland is a good role model.

No comments:

Post a Comment