I’ve been complaining for decades about excessive and wasteful government spending. I’ve also been grousing for just as long about counterproductive, class-warfare tax policy.

Thanks to profligacy in Washington, we’re stumbling and bumbling our way into becoming a sl0w-growth, European-style welfare state.

So I finally decided to do something about it. Or, to be more accurate, I said yes when my friend Les Rubin decided we should co-author a book about America’s fiscal crisis.

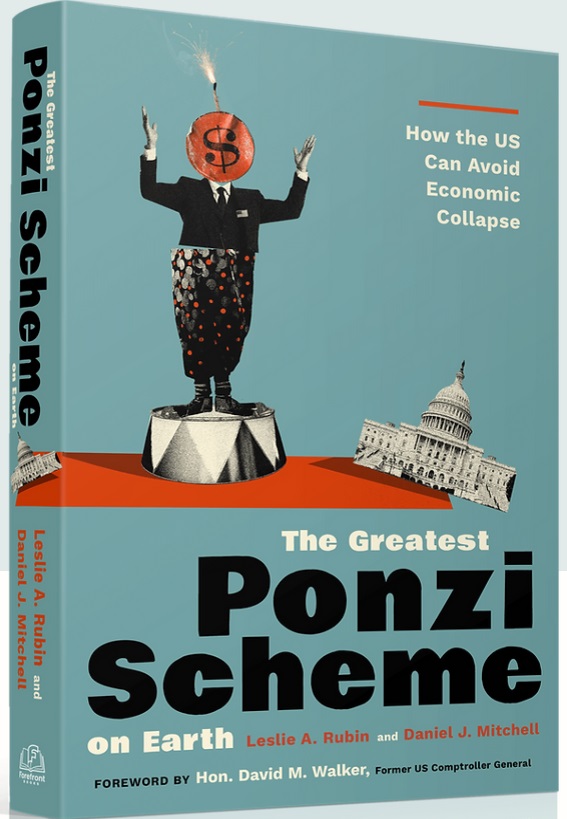

So here it is, The Greatest Ponzi Scheme on Earth. Officially released on March 19.

We didn’t write this book to become rich. If we actually sell enough copies to earn royalties, I’ll be delighted.

Not because of the money, but rather because that will actually show there’s some interest in saving the country from fiscal decay.

To help introduce the book, Les and I just wrote a column for the Foundation for Economic Education. Here are some highlights.

The United States is in fiscal trouble. The burden of government spending has increased by nearly $3 trillion over the past 10 years—nearly doubling in just one decade! And that…is bad news whether the spending is financed by taxes, borrowing, or money printing. To make matters worse, the burden of spending will get even heavier in the coming decades, mostly because politicians have saddled the nation with poorly designed entitlement programs…

To raise the alarm, we’ve written a book, The Greatest Ponzi Scheme on Earth, that explains America’s fiscal mess. It explains how we…will suffer an economic crisis if we leave policy on autopilot. That’s the bad news. The good news is that our book shows that the…reasonable solution…is for government spending to grow slower than the economy. …Politicians could still increase spending, but only by modest amounts. Maybe 2 percent annual spending increases rather than the 7+ percent spending increases that we’ve seen over the past 10 years. In our book, we show examples of countries that have long-run spending restraint (super-successful economies such as Switzerland and Singapore). But we also show examples of nations that dug themselves out of fiscal trouble merely by having multi-year periods of spending restraint. And if countries such as New Zealand, Canada, and Sweden can address their fiscal problems, surely we should demand the same from the crowd in Washington.

As you might expect, we also show how countries like Greece got in trouble.

We also describe the entitlement reforms that are needed to save America from that fate.

And it goes without saying (but I’ll say it anyhow) that we explain how a Swiss-style or TABOR-style spending cap is needed to impose some discipline on reckless, self-serving politicians.

I’ve never used my daily columns to raise money for my group, the Center for Freedom and Prosperity, but peddling the book is different because it will be a tangible and mutually beneficial exchange. Isn’t the free market wonderful?

No comments:

Post a Comment