President Biden has proposed a massive $2 trillion-plus infrastructure plan. Here are the two things everyone should understand.

- It will hurt growth because it will be financed with very harmful tax increases, most notably a big increase in the corporate tax rate that will undermine competitiveness.

- It will hurt growth because the new spending will divert resources from the productive sector of the economy, leading to inefficient allocation of labor and capital.

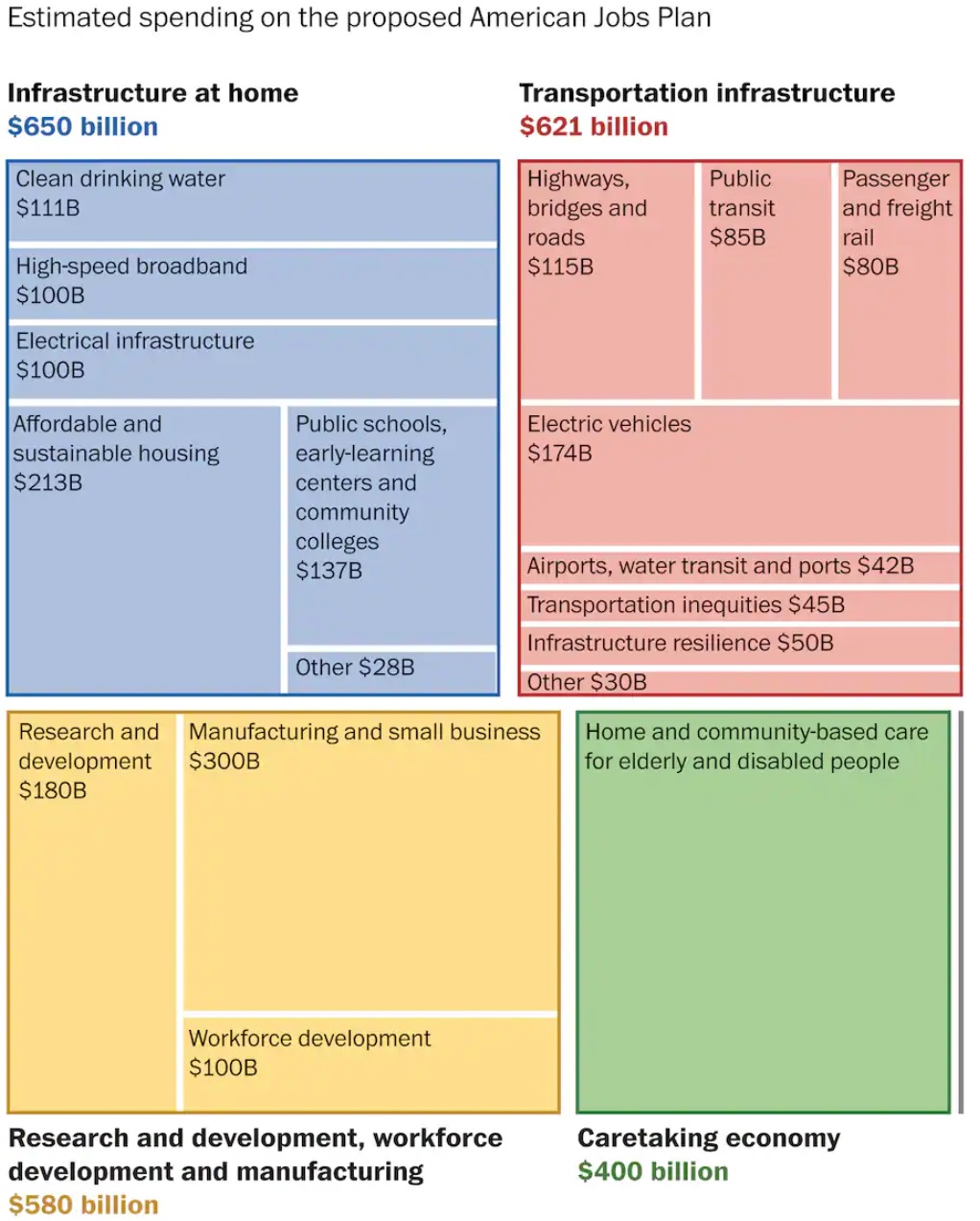

Actually, there’s another thing everyone should understand. As illustrated by this summary from the Washington Post, it’s not really an infrastructure plan. It’s a spend-money-on-anything-and-everything plan, presumably to reward various interest groups.

Though I guess we have to give the Biden Administration points for consistency. The President’s COVID relief plan from earlier this year had very little to do with the pandemic, so we shouldn’t be surprised to see that the infrastructure plan has very little to do with infrastructure.

The Wall Street Journal editorialized about this bait-and-switch scam.

Most Americans think of infrastructure as roads, highways, bridges and other traditional public works. That’s why it polls well… Yet this accounts for a mere $115 billion of Mr. Biden’s proposal. There’s another $25 billion for airports and $17 billion for ports and waterways that also fill a public purpose. The rest of the $620 billion earmarked for “transportation” are subsidies for green energy

and payouts to unions for the jobs his climate regulation will kill. …The magnitude of spending is something to behold. There’s $85 billion for mass transit plus $80 billion for Amtrak, which is on top of the $70 billion that Congress appropriated for mass transit in three Covid spending bills. The money is essentially a bailout for unions… Then there’s $174 billion for electric vehicles, including money to build 500,000 charging stations and for consumer “incentives” on top of the current $7,500 federal tax credit to buy an EV. …Mr. Biden is also redefining infrastructure as social-justice policy and income redistribution. …His plan also includes $213 billion for affordable housing, $100 billion for retrofitting public schools, $25 billion for child-care facilities and $400 billion for increasing home-health care.

Michael Boskin, a professor at Stanford, is not optimistic that Biden’s plan will generate good results.

Joe Biden’s $2.3 trillion infrastructure plan would be many times larger than previous such bills, only about one-third of it would meet even a broad definition of “infrastructure.” …What could possibly go wrong? A lot. …federal spending would crowd out private and local government spending, with a substantial risk of boondoggles piling up along the way.

…The Biden plan is rife with opportunities for earmarked pork-barrel projects (bridges to nowhere) and crony capitalist corporate welfare (next-generation Solyndras). Consider California High-Speed Rail, an infrastructure train wreck that will soon be begging for a bailout from the Biden administration. It originally used a grant from President Barack Obama’s 2009 “stimulus” package to pay, six years later, for a tiny initial rail line. Yet, because the project’s projected total San Francisco to Los Angeles cost has tripled to $100 billion.

And even if the plan was nothing but real infrastructure, that wouldn’t be a cause for optimism.

Kenneth Rogoff, a professor at Harvard, wrote late last year that governments have a terrible track record with cost overruns.

…perhaps the biggest obstacle to improving infrastructure in advanced economies is that any new project typically requires navigating difficult right-of-way issues, environmental concerns, and objections from apprehensive citizens…

The “Big Dig” highway project in my hometown of Boston, Massachusetts was famously one of the most expensive infrastructure projects in US history. The scheme was originally projected to cost $2.6 billion, but the final tab swelled to more than $15 billion… The construction of New York City’s Second Avenue Subway was a similar experience, albeit on a slightly smaller scale. In Germany, the new Berlin Brandenburg Airport recently opened nine years behind schedule and at three times the initial estimated cost.

Amen. I wrote a column about the infamous Second Avenue Subway, and I’ve also repeatedly opined about how government projects always wind up costing much more than initial projections.

Let’s wrap up by looking at an economic analysis of Biden’s plan by the University of Pennsylvania’s Penn Wharton Budget Model.

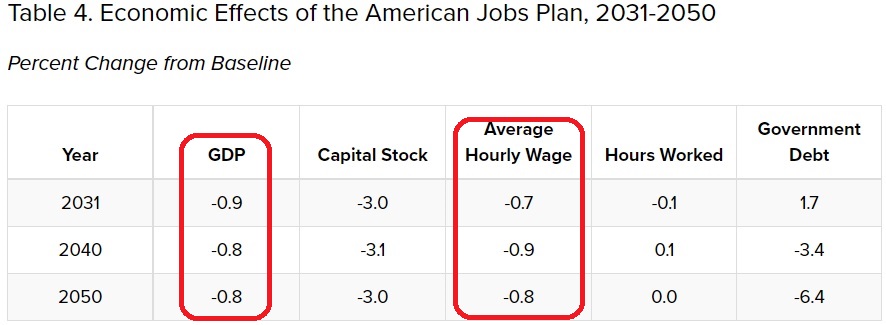

The overall macroeconomic effects of enacting the AJP, including both its spending and tax provisions, are shown in Table 4. …After the AJP’s new spending ends in 2029, however, its tax increases persist—as a result, federal debt ends up 6.4 percent lower by 2050, relative to the current law baseline.

Despite the decline in government debt, the investment-disincentivizing effects of the AJP’s business tax provisions decrease the capital stock by 3 percent in 2031 and 2050. The decline in capital makes workers less productive despite the increase in productivity due to more infrastructure, dragging hourly wages down by 0.7 percent in 2031 and 0.8 percent in 2050. Overall, GDP is 0.9 percent lower in 2031 and 0.8 percent lower in 2050.

Here’s Table 4, which I’ve augmented by circling the two most important statistics.

The immediate lesson from all of this is that Biden’s plan is a boondoggle waiting to happen (just as would have been the case with Trump).

The longer-term lesson is that we should get the federal government out of the business of infrastructure.

No comments:

Post a Comment