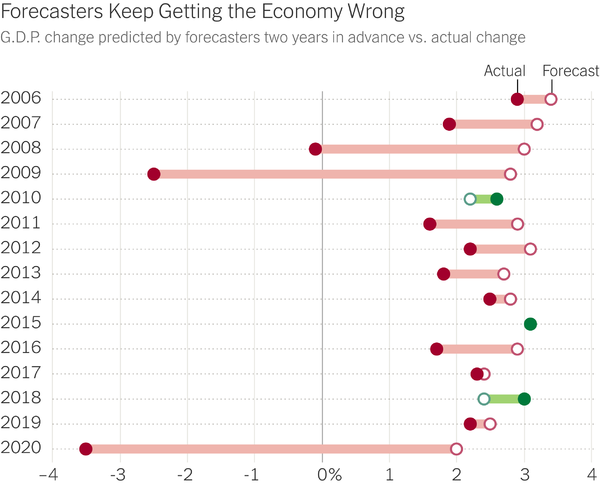

When I wrote the first edition of “Don’t Trust Economists” back in 2010, the column focused on a chart showing that economists failed to predict every major economic downturn for the previous two decades.

Well, we now have some new data making the same point.

Well, we now have some new data making the same point.

To be fair, I wouldn’t blame anybody for bad 2020 predictions. After all, the pandemic was a (hopefully!) one-time event.

But giving economists a mulligan for 2020 doesn’t change the fact that the profession has a notoriously bad track record.

Today, let’s discuss how my fellow economists are lousy forecasters.

Brian Riedl, in a new column for National Review, is not impressed by the profession’s track record.

The next time economists declare that they can project the economy’s performance far into the future, remember that the Federal Reserve recently failed to project even a current-year inflation rate within three percentage points. ..the Federal Open Market Committee (FOMC) forecasted in December 2020 that inflation (as measured by the PCE, the Fed’s preferred measure) would be 1.8 percent in 2021.

…PCE inflation ended up at 5.8 percent for the year. …Then, the FOMC repeated the same error. Even as inflation tore through the 2021 economy, the committee merely nudged up its 2022 inflation projection from 1.9 to 2.6 percent. PCE inflation in 2022 may end up even higher than 2021. And it’s not just the Federal Reserve. The Congressional Budget Office’s 2021 inflation estimate was even lower than that of the Federal Reserve. …macroeconomics…is subject to significant groupthink and overconfidence in its precision, despite a poor record of understanding and projecting the economy’s performance. …economists develop models whose mathematical complexity offers an air of scientific certainty… The result is economists…who are blindsided by market crashes, housing crashes, pandemics, inflation, and rising interest rates. …celebrity economists such as Paul Krugman offer wildly inaccurate forecasts and predictions with the certainty and condescension of a scientist.

If economists really knew how to forecast the economy, they could become very wealthy.

Yet, as Peter Coy explained earlier this year in his column for the New York Times, that is not the case.

…the median annual wages of economists in May 2021 were $105,630. That’s lower than the median pay of astronomers, nuclear engineers, medical dosimetrists and theatrical and performance makeup artists. …Learning a little economics is useful for a lot of lucrative careers, from management to banking.

Warren Buffett, Steven Cohen, Kenneth Griffin, Henry Kravis and Elon Musk are among the billionaires who have bachelor or master degrees in economics. The mistake is loving it so much that you get your doctorate …economists are smart. But some — not the good ones — can be blindered. They know their subspecialties well but are weak on others, such as economic history. These economists have technical expertise but not wisdom. …John Maynard Keynes failed repeatedly as an investor when he tried to use the credit cycle to predict what businesses would do.

This leads us to a column in the Wall Street Journal by Professor Alexander William Salter of Texas Tech University.

He explains that the real problem is that some economists have forgotten (or never learned) the basics of “price theory,” which is the foundation of microeconomics.

Despite the complexities of markets, economists can get at the heart of how they work by focusing on prices. This insight is so important, it gives economists’ core tool kit a name: price theory. …Yet…economists are abandoning price theory in droves.

…The heights of the economics profession are increasingly inhabited by people who disdain price theory. Reliance on the economic way of thinking in solving problems is viewed as obsolete and unscientific. …The opposite is closer to the truth. Old-school economics recognized that trade-offs and constraints are everywhere. There are no free lunches. …To fix economics, economists must again insist on the primacy of price theory. The economic way of thinking is not optional. Nor is it an impediment to social science. In fact, price theory is the only thing that makes social science possible.

At the risk of over-simplifying, a potential lesson to be learned is that we should trust (or at least listen to) microeconomists while being skeptical of macroeconomists.

P.S. While the moral of the story is that some economists make lots of mistakes because they overlook price theory, sometimes economists are explicit fraudsters.

P.P.S. Here’s an entertaining cartoon strip about economists.

P.P.P.S. I’ll close with a plug for the Austrian School of economics.

No comments:

Post a Comment