As an economist, I can immediately think of several ways that big government is bad news for poor people.

- Redistribution programs that trap poor people in dependency

and produce inter-generational poverty.

and produce inter-generational poverty. - Government schools that do an awful job of providing education to children from low-income families.

- Fiscal policies that hurt growth and lead to lower incomes and fewer job opportunities for the less fortunate.

But that’s only a partial list. Today, let’s peruse a report from a few weeks ago in the New York Times.

Authored by Robin Kaiser-Schatzlein, it shows how poor people are routinely victimized by greedy and grasping government in Alabama.

In states like Alabama, almost every interaction a person has with the criminal justice system comes with a financial cost. If you’re assigned to a pretrial program to reduce your sentence, each class attended incurs a fee. If you’re on probation, you’ll pay a fee to take your mandatory urine test.

If you appear in drug court, you will face more fees, sometimes dozens of times a year. Often, you don’t even have to break the law; you’ll pay fees to pull a public record or apply for a permit. For poor people, this system is a trap… I asked almost everyone I met — gas station attendants, Starbucks baristas and grocery store clerks of all races — if they knew anyone who had been affected by court fines and fees. Many told me stories of family and friends who had. Some had themselves.

The story includes several anecdotes about people who get nailed by endless fees and charges.

Here’s just one example.

Niaya Williams…began driving hours each day back and forth from her job at McDonald’s and his day care. …she started getting ticketed quite frequently. She remembers that one day, she got her first set of tickets for, among other things, not stopping long enough at a stop sign. … ticket for not having a license, a ticket about switched tags that she didn’t fully understand and a ticket because the officer said Mercury was buckled incorrectly. She recalled being given at least three tickets every time she was pulled over. …She was…arrested because of just traffic infractions and missed court dates, Mrs. Williams said. She was, in essence, guilty of little else than being too poor to pay off her fines.

Echoing what I wrote back in 2015, the author notes that this is not a problem unique to Alabama.

States found fines and fees to be an expedient source of revenue, operating under the radar as what some scholars call nontax taxes. …A 2019 Governing magazine study of cities, towns and counties with significant revenue from fees and fines showed that nearly 600 jurisdictions relied on fines and forfeitures for more than 10 percent of their revenue and 80 relied on fines and forfeitures for over half their revenue. …“Fees are not about public safety,” said Lauren-Brooke Eisen of the Brennan Center for Justice. “They’re about raising revenue.”

Unfortunately, there is a big logical flaw in the story.

Ms. Kaiser-Schatzlein wants readers to think that Alabama is pillaging poor people because of low taxes and small government.

Alabama has one of the cruelest tax systems in the country. Taxes on most property, for example, are exceptionally low. …millions of others in the state live in the wreckage of a system starved of funding: The state has chronically underfunded schools, bad public transit, a dearth of well-paying jobs, little affordable child care and a diminishing health care system. …Most places have a simple and effective method for quickly ameliorating these problems: They raise property or income taxes. But Alabama often refuses to do so or makes it exceptionally difficult, dooming many to living standards unthinkable for a country as rich as the United States.

Too bad she didn’t do any research on this part of her story.

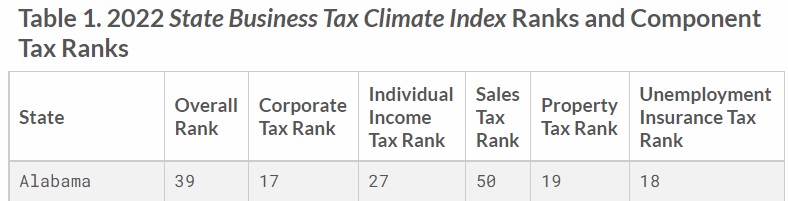

She could have looked at the latest edition of the Tax Foundation’s State Business Tax Climate Index and learned that Alabama actually has one of the nation’s greediest tax systems.

And if Ms. Kaiser-Schatzlein had spent a few minutes looking at data from the Census Bureau, she would have learned that Alabama is hardly a beacon of limited government.

I crunched the numbers two years ago and found that spending by state and local governments in Alabama was way above average when measured as a share of state income. And it was about average when measured on a per-capita basis.

I’ll conclude by observing that there are many states that have very low tax burdens and relatively low levels of government spending, way below Alabama. Including other southern states such as Florida and Texas, not just places like South Dakota and New Hampshire.

If such policies are a recipe for hurting the poor, why are so many Americans of all income levels migrating to those places?

No comments:

Post a Comment